Project Spotlight: Keel

Keel: Solana's Capital Engine

Introducing Keel

Keel is an automated capital engine that operates within the Sky Protocol (formerly MakerDAO) agent framework, in a similar manner to current agents Spark and Grove. Keel aims to become Solana's largest onchain balance sheet while pioneering the infrastructure needed for tomorrow's tokenised economy. Keel currently has a roadmap to deploy up to $2.5 billion into the Solana ecosystem, ramping up over coming months.

"Keel was founded on the belief that the next phase of on-chain finance growth needs more than new assets alone; it needs liquidity that can be accessed at speed and scale," said Cian Breathnach, CEO of Matariki Labs and a contributor to Keel. "Keel is the first to provide these enablers on Solana, delivering the capital and catalyzing force for the next stage of growth in on-chain lending, borrowing, tokenization and more."

What sets Keel apart on Solana is its unique position within the Sky ecosystem, which provides exclusive access to predictable, low cost borrowing in Sky’s native stablecoin USDS that traditional capital allocators simply cannot match. Operating with 100% protocol owned assets and no external custodians, Keel captures spreads relative to its advantaged cost of capital.

The protocol utilises the Sky Allocation System to dynamically reallocate stablecoin capital within predetermined parameters set by governance, creating an atomically elastic balance sheet that can respond to market opportunities within seconds.

The Market Opportunity

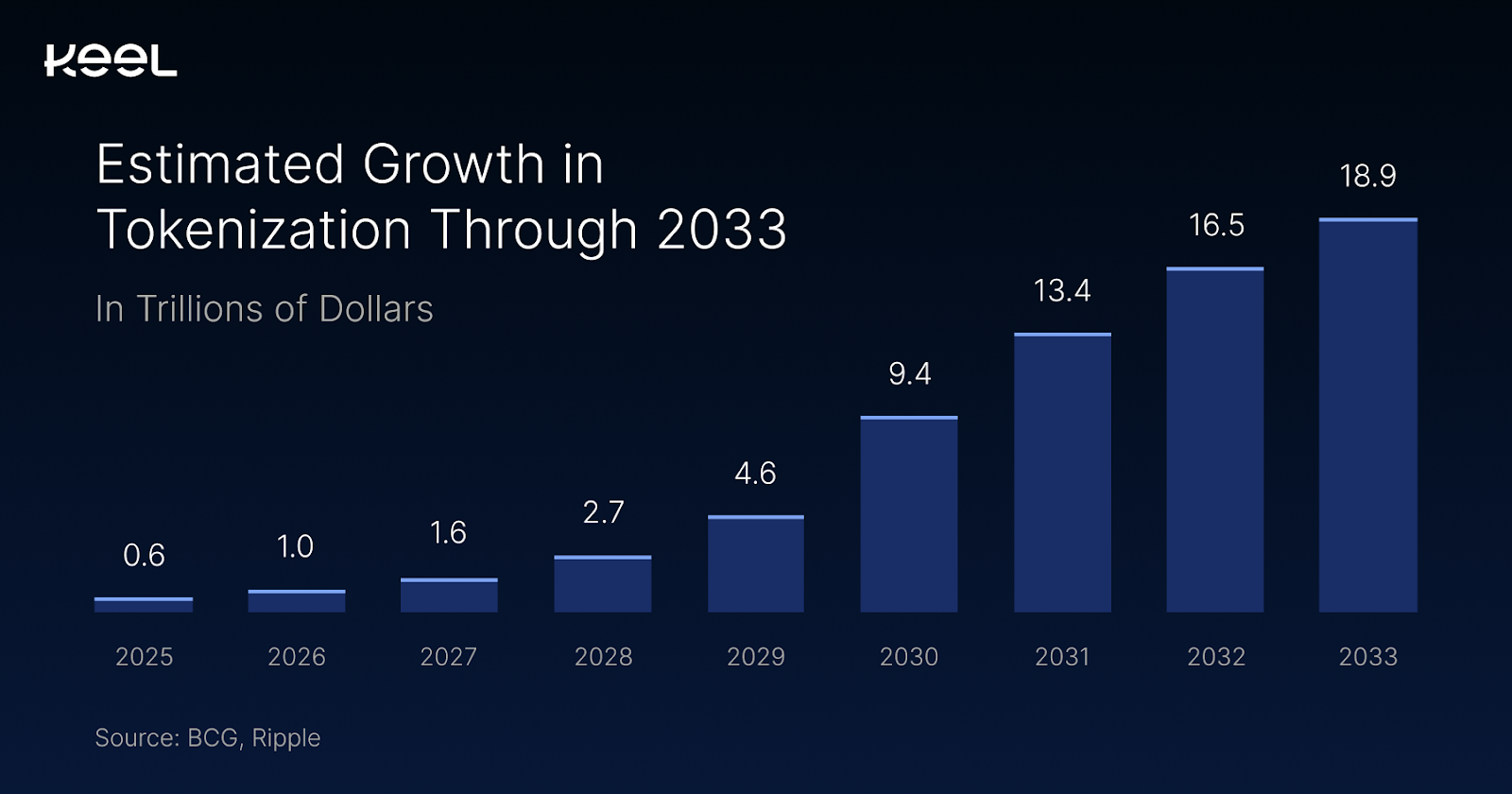

A massive structural shift is underway as the world's collateral assets migrate onchain, creating what may be the largest capital flow opportunity in financial history. Standard Chartered projects onchain tokenised assets to reach $30 trillion by 2034, while BCG forecasts $19 trillion by 2033.

This isn't just about digitising existing assets—tokenisation enables huge improvements in scope for collateralised lending, secondary market liquidity, and operational efficiency. The model allows access to liquid borrowing against financial instruments and leverage positions at better terms for both individuals and institutions.

Demand for lending, liquidity, and bank-like enablers is growing rapidly in this new paradigm shift. While existing DeFi protocols lack the scale and flexibility needed to serve institutional needs. This creates a massive opportunity for protocols that can bridge both worlds.

Keel is strategically positioned to lay the groundwork for the necessary credit rails as this forecasted shift unfolds providing swap, lending, and liquidation liquidity that tokenised markets require. As both a capital allocator and a partner to asset issuers and protocols, Keel aims to play a leading role in shaping Solana's DeFi and RWA landscape.

Keel's Pioneer Star Status

Within Sky's sophisticated Agent Framework, Keel has been designated 'Pioneer' status over the Solana ecosystem—something that creates unique advantages unavailable to any other protocol in the space.

The scope of Pioneer responsibilities extends across the entire Solana financial stack. Keel serves as Sky's primary interface with the Solana ecosystem. This includes developing the technical primitives that allow seamless interaction between Sky's Ethereum-based core and Solana's high performance environment.

Keel's Pioneer responsibilities include:

- Infrastructure Development: Building and maintaining core Sky infrastructure on Solana, including SVM (Solana Virtual Machine) primitives for native Solana access to Sky and USDS.

- Partnership Management: Managing relationships with ecosystem partners and protocols across the entire Solana landscape.

- Incentive Programs: Directing comprehensive programs on behalf of Sky to grow USDS adoption and ecosystem integration on Solana.

- Market Catalyst: Serving as both enabler and catalyst for asset issuers and protocols throughout the ecosystem.

- Cross Chain Integration: Developing and maintaining the bridge infrastructure that connects Sky's Ethereum operations with Solana's expanding DeFi ecosystem.

- Ecosystem Growth: Actively fostering the development of new financial products and services that leverage Sky's infrastructure on Solana.

Savings Product for the Solana Ecosystem

Keel's functions on Solana extend beyond capital allocation, into facilitating and maintaining access to the Sky sUSDS savings product, which provides predictable and continuously compounding yield via the Sky Savings Rate.

The Sky Savings Rate provides institutional grade yield, accredited by S&P Global, and backed by Sky's diversified collateral portfolio. The infrastructure leverages Sky's scale—over $8 billion USDS in circulation—to provide reliability that smaller protocols cannot match. The native Solana implementation will maintain the high standards of retail user experience expected in the ecosystem while providing the robust backend infrastructure necessary for institutional adoption.

This creates a virtuous cycle for Keel's business model. The protocol generates sustainable revenue through Sky’s Accessibility Reward, a commission-like structure based on USDS and sUSDS adoption growth, aligning user value creation with the protocol's success. When live, as more Solana users access the Sky Savings Rate through Keel's infrastructure, both the ecosystem and the protocol benefit, strengthening Sky's presence on Solana while generating income for Keel.

Why Keel Has an Advantage as a Sky Agent Capital Allocator

Keel's position as a Sky Agent creates structural advantages that would be impossible to replicate outside this framework, fundamentally changing the economics of capital allocation.

Predictable Capital Costs

While traditional capital allocators face unpredictable funding costs that can swing dramatically with market conditions, Keel's cost of borrowing is set through governance and remains stable over weeks to months. Traditional capital allocators must constantly adjust strategies based on changing borrowing rates and investor redemptions. Any return in excess of this borrowing cost accrues as profit to Keel.

Elastic Scaling

Traditional capital allocators face fundamental constraints based on their ability to grow deposits or raise capital and the opportunity costs of undeployed funds. They must predict opportunities in advance and maintain dry powder on their balance sheet even during quiet periods.

Keel can deploy and contract capital allocations in response to market opportunities within seconds. The protocol's balance sheet can scale dynamically, responding immediately to demand spikes or sudden liquidity shocks. This responsiveness creates a powerful competitive moat in fast moving DeFi markets.

Institutional Grade Risk Management

Unlike traditional DeFi protocols that must bootstrap their own capital, Stars operate within Sky's Risk Capital system, which includes:

- Senior Risk Capital (SRC): Provided by Sky through monthly origination processes

- Junior Risk Capital (JRC): A multi layered protection system including Internal JRC, external rentals, and tokenised external capital

Drawing inspiration from Basel III banking regulations, Star protocols maintain multiple layers of capital buffers as a part of Junior Risk Capital designed to absorb ‘first losses’, protecting USDS holders against the various risks to which an allocator is exposed.

Through Sky's Risk Capital system, Keel’s capital adequacy frameworks factors:

- Financial Risk Capital: Covering market, credit, and liquidity risks

- Smart Contract Risk Capital: Protecting against technical exploits

- Administrative Risk Capital: Guarding against governance attacks or other operational failures

Keel's compliance is continuously monitored and enforced in real time by automated systems established within Sky’s Agent Framework.

- Dynamic Updates: Real-time risk parameter adjustments based on market conditions

- Continuous Monitoring: Automated compliance enforcement without human delays

All assets remain protocol owned with no external custodians, removing centralised custody risks. This approach provides transparency and security that traditional finance cannot match while maintaining institutional grade risk standards.

Network Effects

Traditional capital allocators operate in silos—lending desks don't share insights with trading operations, and market making activities are disconnected from investment strategies. Keel's integrated approach creates network effects where each business line strengthens the others.

The protocol's lending operations generate data that informs allocation decisions. Swap liquidity informs emerging trends. This interconnected approach creates competitive advantages that would be difficult for individual specialised competitors to replicate. In addition to this Keel's substantial capital base provides negotiating power for preferential terms that smaller players cannot access.

Where Keel Plans to Allocate Capital

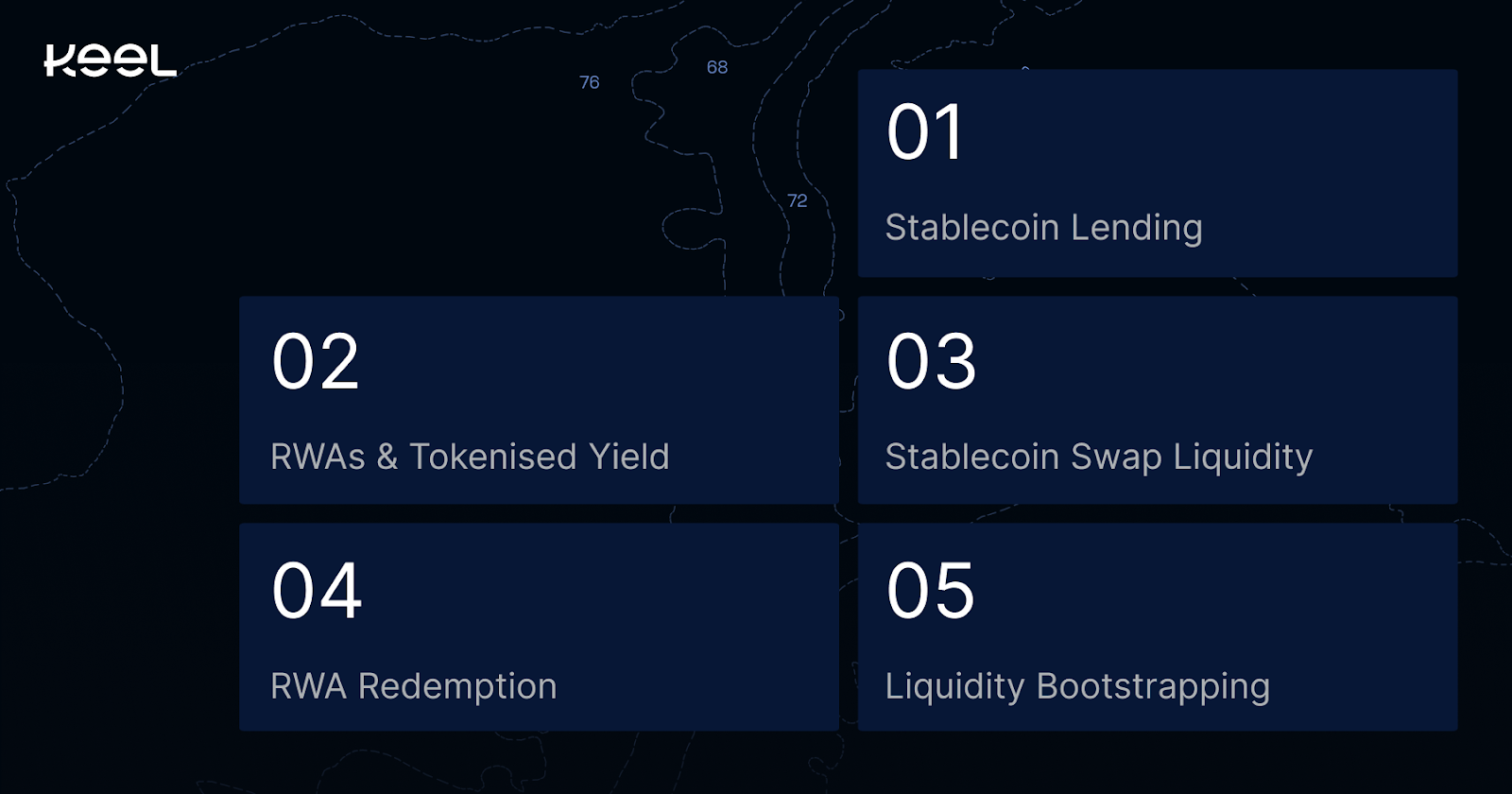

Keels allocation activities are anticipated to span a number of complementary pillars, all major enablers for the Solana DeFi ecosystem and the next wave of institutional involvement.

Stablecoin Lending

Keel dynamically allocates stablecoin liquidity into over collateralised lending markets across Solana DeFi, intending to maintain a minimum of 25% of its balance sheet in liquid USD stablecoin positions. This serves a dual purpose, generating steady returns while meeting Sky's liquidity commitments.

The protocol's access to Sky's capital at predictable rates allows it to offer competitive lending terms while maintaining healthy spreads.

RWAs & Tokenised Yield

As real world assets migrate onchain, Keel provides scalable allocation into yield bearing RWAs and tokenised strategies. The protocol's substantial capital base and Pioneer status provide preferential terms with issuers—relationships that smaller competitors cannot establish.

This positioning is particularly valuable as institutional demand for tokenised assets grows exponentially. Keel can capture first mover advantages in emerging asset classes while providing the liquidity and price discovery mechanisms that allow new tokenised markets to thrive.

Stablecoin Swap Liquidity

Keel provides atomic swap liquidity for leading stablecoin pairs, serving the critical infrastructure needs of the growing stablecoin ecosystem. New stablecoin issuers subsidize quality swap liquidity to gain market access, and Keel's substantial liquid positions enable competitive service provision.

This creates a sustainable revenue stream while strengthening the broader Solana ecosystem that Keel operates in.

Improving the quality of stable-to-stable execution improves swap execution from stablecoins into in turn improves execution of stable to the collateral assets typically borrowed against – in turn, improving Keel’s capacity to lend in these stablecoins.

RWA Redemption & Secondary Liquidity

Real world assets often lack liquid secondary markets, creating friction for institutional adoption. Keel's instantly scalable balance sheet enables the possibility of warehousing these assets through their redemption period, providing the liquidation bid required to enable RWA lending markets.

This positions Keel as an essential infrastructure for RWA growth in the Solana ecosystem.

Liquidity & TVL Bootstrapping

Keel access to large stablecoin reserves mean it is positioned to support bootstrapping of new protocols and issuances, aligning with its Pioneer mandate to support ecosystem development. This allows for access to promising opportunities while supporting emerging initiatives on Solana

Scaling DeFi on Solana

Keel represents the evolution of capital allocation enabled by onchain dynamics—a protocol that combines the best of traditional institutional risk management with the diverse range of opportunities on offer on Solana. Keel has already announced numerous partners that will accelerate its impact in the Solana ecosystem.

The protocol's structural advantages would be impossible to replicate outside the Sky ecosystem: predictable low cost capital access that traditional allocators cannot obtain, elastic balance sheet scaling that responds to opportunities in seconds rather than months, sophisticated risk management that exceeds most institutional standards, and Pioneer responsibilities that create sustainable competitive moats.

As the world's collateral assets move onchain over the next decade, Keel is building the critical financial enablers and credit rails that will power this $30 trillion transformation. Nevertheless the protocol does not limit itself, its comprehensive five pillar strategy positions it to capture value across all promising market segments.

The convergence of Sky's proven capital engine and Keel's Pioneer mandate on Solana creates an unprecedented foundation for capturing value at the intersection of DeFi, RWAs, and stablecoins.