Project Spotlight: Decentralized USD

USDD 2.0: From Tron to Ethereum and Beyond

Launched in May 2022 by the TRON DAO Reserve (TDR), Decentralised USD (USDD) began as a hybrid algorithmic stablecoin. However, in a strategic response to historical skepticism surrounding algorithmic models the project underwent a significant restructuring in January of 2025 which brought a pivot toward an Over Collateralised Decentralised Stablecoin (OCDS) architecture. This allowed USDD, rebranded as USDD 2.0, to be underpinned by the battle tested Collateral Debt Position model, initially popularised by Sky (fka MakerDAO) and their stablecoin DAI, enhancing trust in USDD security through a transparent asset backed structure.

The fundamental purpose of USDD is to provide a decentralised, censorship resistant alternative to conventional Cash Stablecoins such as USDC and USDT which are subject to the centralised oversight of private companies holding short term treasuries as collateral.

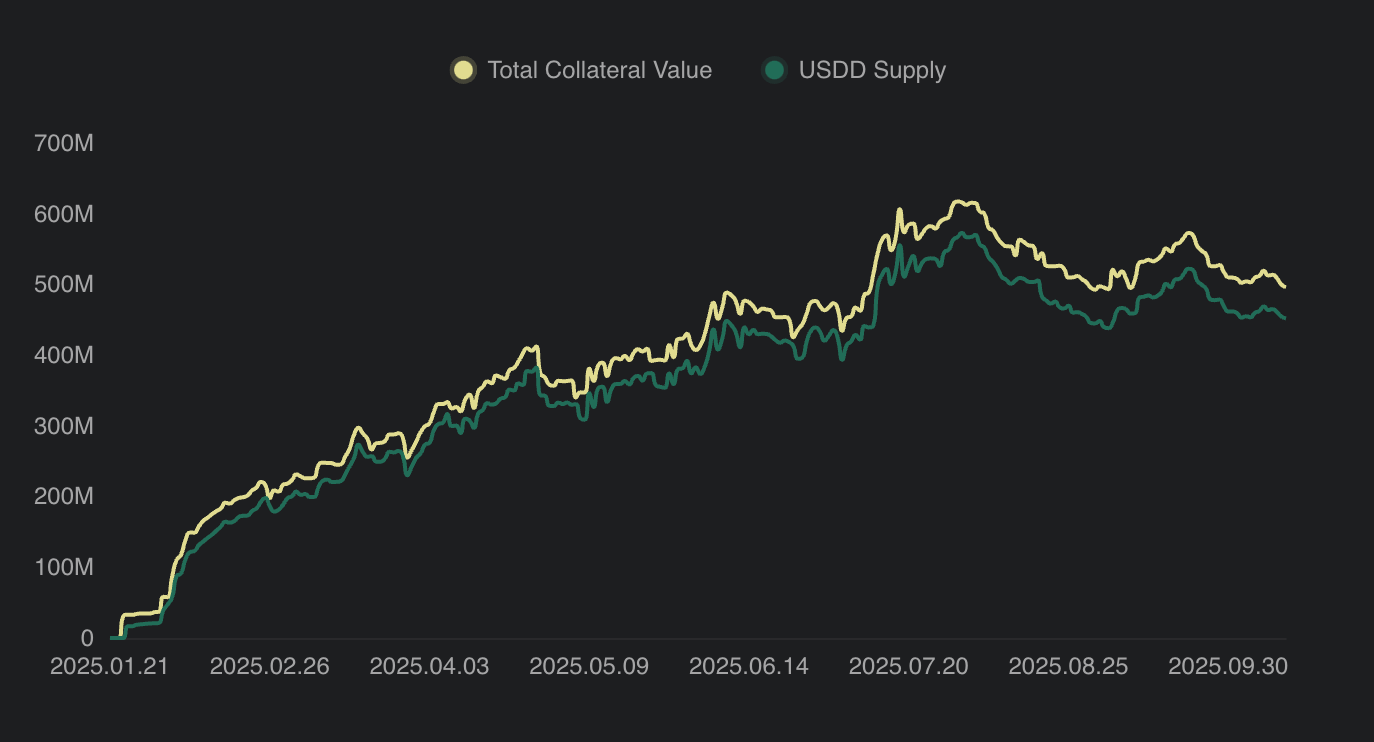

USDD Growth

Since the upgrade to USDD 2.0, the stablecoin has experienced tremendous growth, tripling in market capitalisation in the span of 8 months. USDD now maintains a substantial presence within the stablecoin market, with a circulating supply of $462.58M.

USDD first launched on TRON, however it since expanded native deployment to Ethereum on the 8th of September 2025. Over $8M of USDD was minted on Ethereum within 4 days of the launch. Currently USDD supply on Ethereum stands at $8.88M, while TRON native supply is at $452.42M.

Collateral backing always exceeds supply of USDD, currently TRON-based collateral is worth $496.76M while Ethereum based collateral value is at $9.34M.

TRON Based USDD Supply & Collateral

As of the release of this article USDD has made the strategic decision of expanding native issuance of the stablecoin to Binance Smart Chain, in order to grow the range of protocols and services the stablecoin can interact with. This move is poised to significantly increase the total addressable market of USDD.

Core Architecture

USDD’s stability framework rests on four interlinked technical components that work synergistically to maintain the dollar peg.

The overcollateralisation system maintains a transparent, verifiable reserve of liquid assets managed by the protocol. The collateralisation system requires minimum ratios ranging between 120%-150% between liabilities (USDD) and assets for cryptocurrencies. Currently all collateral vaults except for USDT-A exceed 250% collateralisation indicating a healthy state of affairs for USDD.

The Collateralized Debt Position (CDP) model serves as the core engine for USDD creation, allowing users to lock eligible assets such as TRX, sTRX, and USDT into Vaults and mint USDD against the locked value. The system is permissionless, however as mentioned prior, requires an overcollateralisation where the market value of locked assets has to always exceed the USDD debt value. Users must repay the minted USDD plus the accumulated Stability Fees, to retrieve their collateral. These fees serve as the primary levers to manage supply and demand dynamics.

The Peg Stability Module (PSM) provides a dedicated zero-slippage swap mechanism that maintains USDD’s 1:1 parity with the US dollar. Through the PSM, users can facilitate exchanges into and out of USDD with USDT on TRON, in addition to both USDT and USDC on Ethereum. When USDD trades below $1, arbitrageurs purchase discounted USDD and swap it for par-value stablecoins via the PSM. Conversely, when USDD trades above $1, users swap $1 of stablecoins for USDD and sell for profit. This constant arbitrage pressure mitigates volatility of USDD’s price, though the PSM's efficacy depends entirely on the size of USDT and USDC (USDC is only on Ethereum) reserves, currently at $60.14M on TRON and $10.74M on Ethereum.

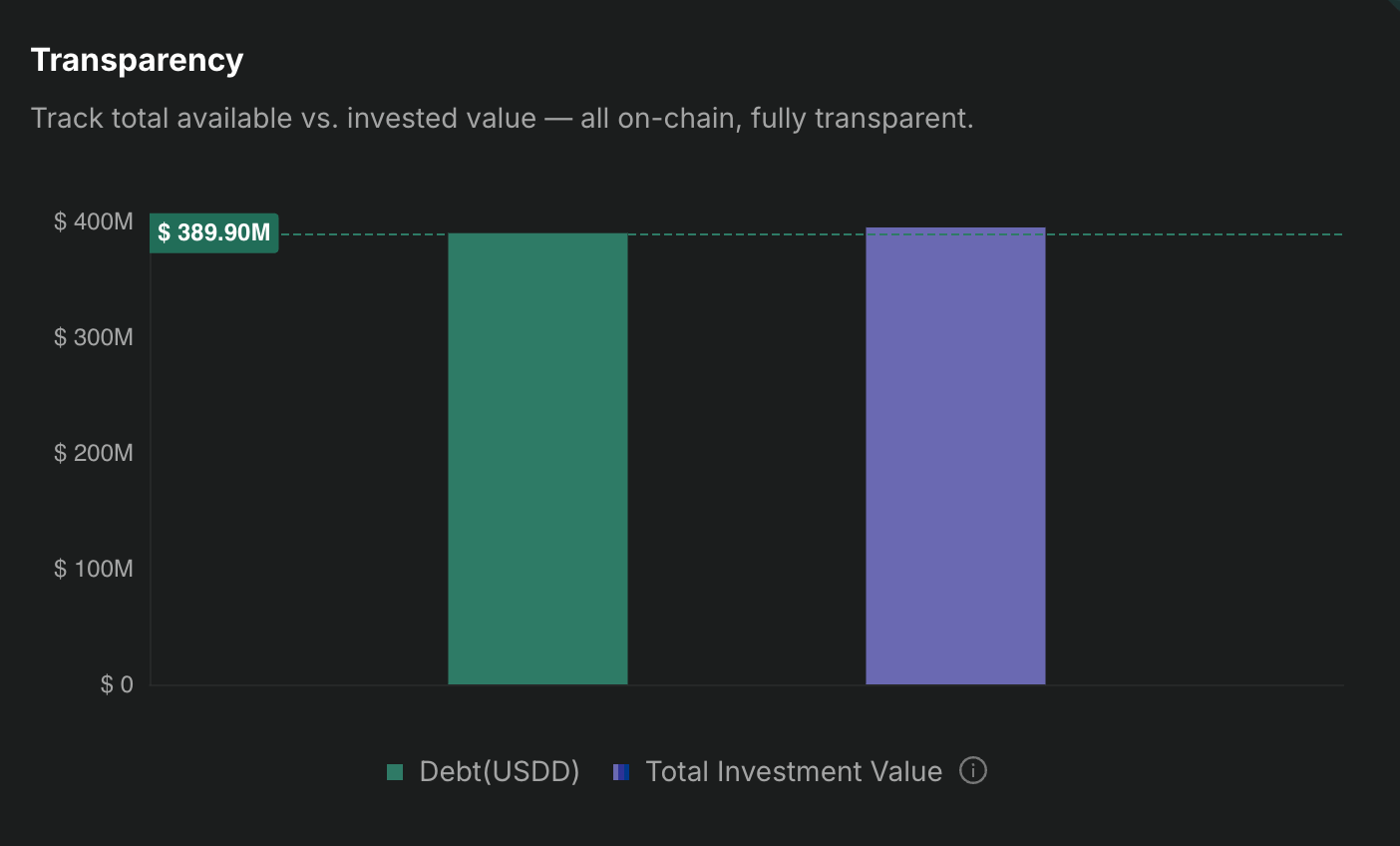

Smart Allocator is a yield engine that strategically deploys part of USDD’s cash reserves into established DeFi protocols to generate sustainable protocol revenue. Capital from USDD's cash reserve is placed into carefully chosen investment platforms such as Aave and JustLend. Returns are redistributed to users as staking rewards through an automated, auditable process. Currently APY on Smart Allocator is 3.94% with $4.93M in earnings on an allocated total of $394.84M.

Collateral Management

Collateral for USDDl includes TRX - the native token of the TRON blockchain, sTRX - the staked version of TRX, and additionally the cash stablecoin USDT. All collateral is held in publicly verifiable smart contracts with specific addresses on TRON and Ethereum, enabling real time verification of reserves. This can be found on the USDD data dashboard.

The primary use case of USDD is to allow holders of TRX to gain liquidity for their holdings without having to sell the underlying asset. This is facilitated by the three TRX vaults that allow minting of USDD, namely TRX-A, TRX-B and TRX-C. However, users may also mint USDD with TRX staked with JustLend DAO through the sTRX-A Vault allowing them to accrue the 6.74% APY paid out on sTRX in addition to having immediate liquidity through USDD.

Finally the SA001-A Vault represents the aforementioned Smart Allocator, which allows USDD stakers on DeFi protocols and sUSDD holders to benefit from additional yields while still having a composable stablecoin in USDD.

The range of vaults greatly enhance capital efficiency allowing for the benefit of the greater TRON ecosystem.

TRON USDD Collateral

Ethereum USDD Collateral

Liquidation & Auction Mechanism

USDD employs rigorous automated liquidation and auction mechanisms to preserve solvency and eliminate undercollateralised debt. CDP Vaults are continuously monitored by automated systems called "Keepers," with liquidation automatically initiated when a Vault's Collateralization Ratio drops below the predetermined Liquidation Ratio. For example, if the Liquidation Ratio is set at 150%, a Vault becomes eligible for liquidation at 149% of minted USDD debt.

Upon triggering, collateral transfers from the user's Vault to the protocol. Vault owners face Liquidation Penalties added to the outstanding debt. This penalty compensates the protocol for insolvency risk while incentivizing borrowers to proactively manage positions by adding collateral or partially repaying debt before reaching the Liquidation Ratio. Following liquidation, collateral is sold through decentralized auctions using a Dutch auction model where prices decrease over time.

The systematic price reduction ensures that even during extreme volatility or network congestion, collateral is eventually purchased, securing protocol debt coverage. Once sold, received USDD is burned to maintain system stability, with any remaining collateral after debt repayment and fees, returned to the original Vault owner.

The Risk Alert feature provides multi-channel notifications through page alerts and email notifications in order to protect users from liquidations. High Risk Alerts trigger when Collateral Ratio is less than 5% above liquidation line, while Moderate Risk Alerts trigger at less than 10% above liquidation line.

USDD Yield & Ecosystem Integrations

Chosen integrations of USDD are chosen by the USDD and JUST DAO teams, current implementations include a range of DeFi primitives both on TRON and Ethereum. JustLend on TRON serves as the main lending partner, forming the foundation for sTRX CDP strategy, while the Ethereum integration of the Smart Allocator with Aave provides conservative lending yield.

DeFi Yield

Users may also use their USDD in the available DeFi applications on TRON. These include the premier DEX SunSwap where USDD can be used to provide liquidity for USDD/TRX and USDD/USDT pairs. Additionally USDD may be lent out on the TRON native money market JustLend for an APY of 5.01%.

Centralised Exchange Yield

On TRON USDD has a series of yield opportunities on centralised exchanges detailed in the table below:

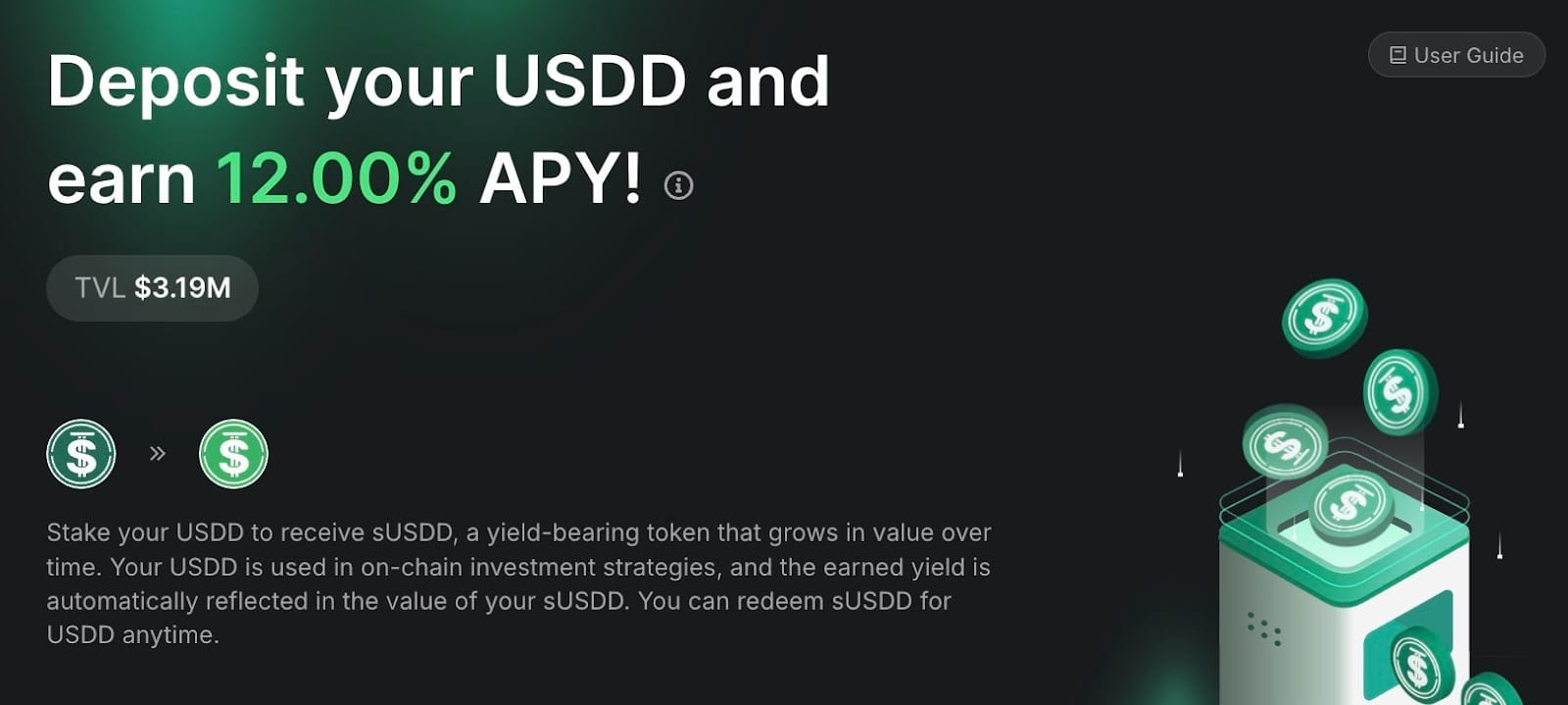

USDD Savings

The newest yield product introduced for USDD is sUSDD, which was launched on October 6th 2025. sUSDD provides holders of USDD access to 12% yield generated through protocol activities. sUSDD can be minted on Ethereum mainnet with USDD and continuously accrues value through a constantly appreciating exchange rate, calculated as the total USDD in the contract divided by the circulating sUSDD supply. The protocol states that this appreciation is fueled by yield from smart allocator revenue. Since launch the APY has remained fixed at 12%.

sUSDD APY

Conclusion

USDD has established itself as a cornerstone of the TRON blockchain, providing a robust, overcollateralized alternative to centralised stablecoins such as USDT which currently dominates payments on TRON. With a market capitalization of $462.58M and collateralization ratios consistently exceeding 250%, the strategic pivot to USDD 2.0's Collateral Debt Position model has proven highly successful.

The stablecoin's multichain expansion strategy demonstrates an ambition to become a mainstay in the broader DeFi ecosystem. USDD launch on Ethereum brought an additional $8.8M in TVL and introduced a new primitive to the protocol–sUSDD. The Binance Smart Chain integration will likely greatly extend USDD's reach as well, dramatically increasing its total addressable market and enabling interaction with a broader range of DeFi protocols.

As USDD expands across chains and deepens ecosystem integrations, it positions itself as a credible decentralised alternative to USDC and USDT, backed by verifiable reserves.